Tesla stock price continues to be one of the most talked-about topics in the investment world, capturing the attention of both seasoned investors and newcomers alike. As one of the leading companies in electric vehicles (EVs) and renewable energy, Tesla has consistently shown impressive growth, making its stock a highly sought-after asset. Whether you're looking to invest or simply want to understand how Tesla's stock is performing, this article will provide you with all the essential information you need.

Tesla's journey from a startup to a global powerhouse has been nothing short of remarkable. The company's innovative approach to electric vehicles, coupled with its commitment to sustainability, has positioned it as a leader in the industry. As a result, Tesla's stock price has become a key indicator of the company's success and future potential.

In this guide, we will delve into the factors influencing Tesla's stock price, analyze its historical performance, and explore what the future might hold for investors. Whether you're a long-term investor or a short-term trader, understanding Tesla's stock dynamics is crucial for making informed financial decisions.

Read also:Essential Clarence Gilyard Facts Everything You Need To Know

Table of Contents

- Introduction to Tesla

- Tesla Stock Historical Performance

- Factors Affecting Tesla Stock Price

- Investment Opportunities in Tesla

- Market Analysis of Tesla Stock

- Risks Associated with Tesla Stock

- Future Outlook for Tesla Stock

- Expert Predictions and Forecasts

- Tips for Investors Considering Tesla Stock

- Conclusion

Introduction to Tesla

Tesla, Inc. is a global leader in the electric vehicle (EV) industry and renewable energy solutions. Founded in 2003 by a group of engineers, Tesla aims to accelerate the world's transition to sustainable energy. The company's mission is to reduce global reliance on fossil fuels by producing innovative EVs and energy storage systems.

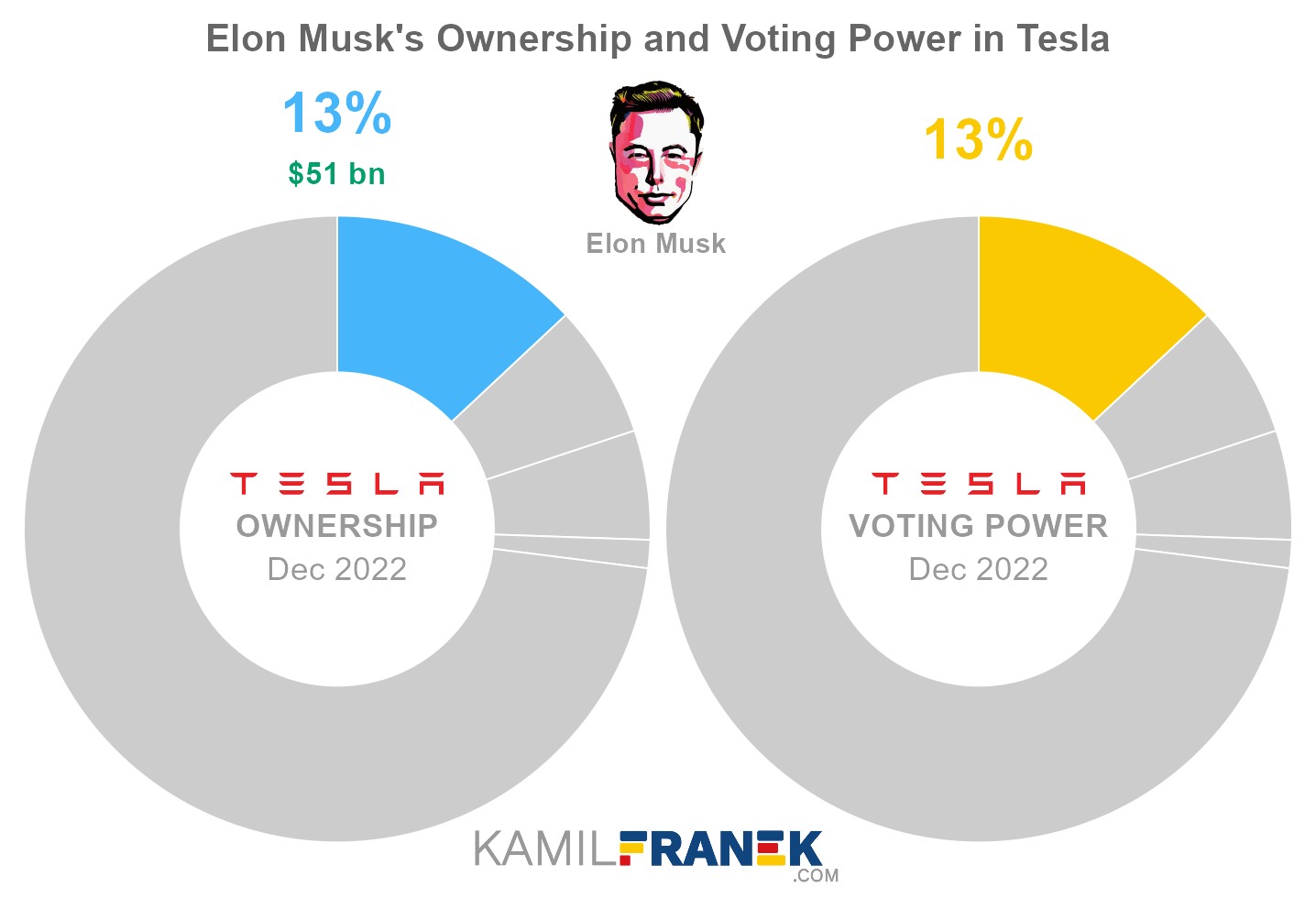

Under the leadership of CEO Elon Musk, Tesla has expanded its product offerings to include not only electric cars but also solar panels, energy storage systems like the Powerwall, and even autonomous driving technology. This diversification has contributed significantly to Tesla's growth and its stock price.

Key Milestones in Tesla's History

Tesla has achieved several milestones that have shaped its stock price and reputation:

- 2008: Introduction of the Tesla Roadster, the first highway-capable EV.

- 2010: Tesla's Initial Public Offering (IPO) at $17 per share.

- 2012: Launch of the Model S, which became a best-selling luxury sedan.

- 2020: Tesla becomes the most valuable automaker globally.

Tesla Stock Historical Performance

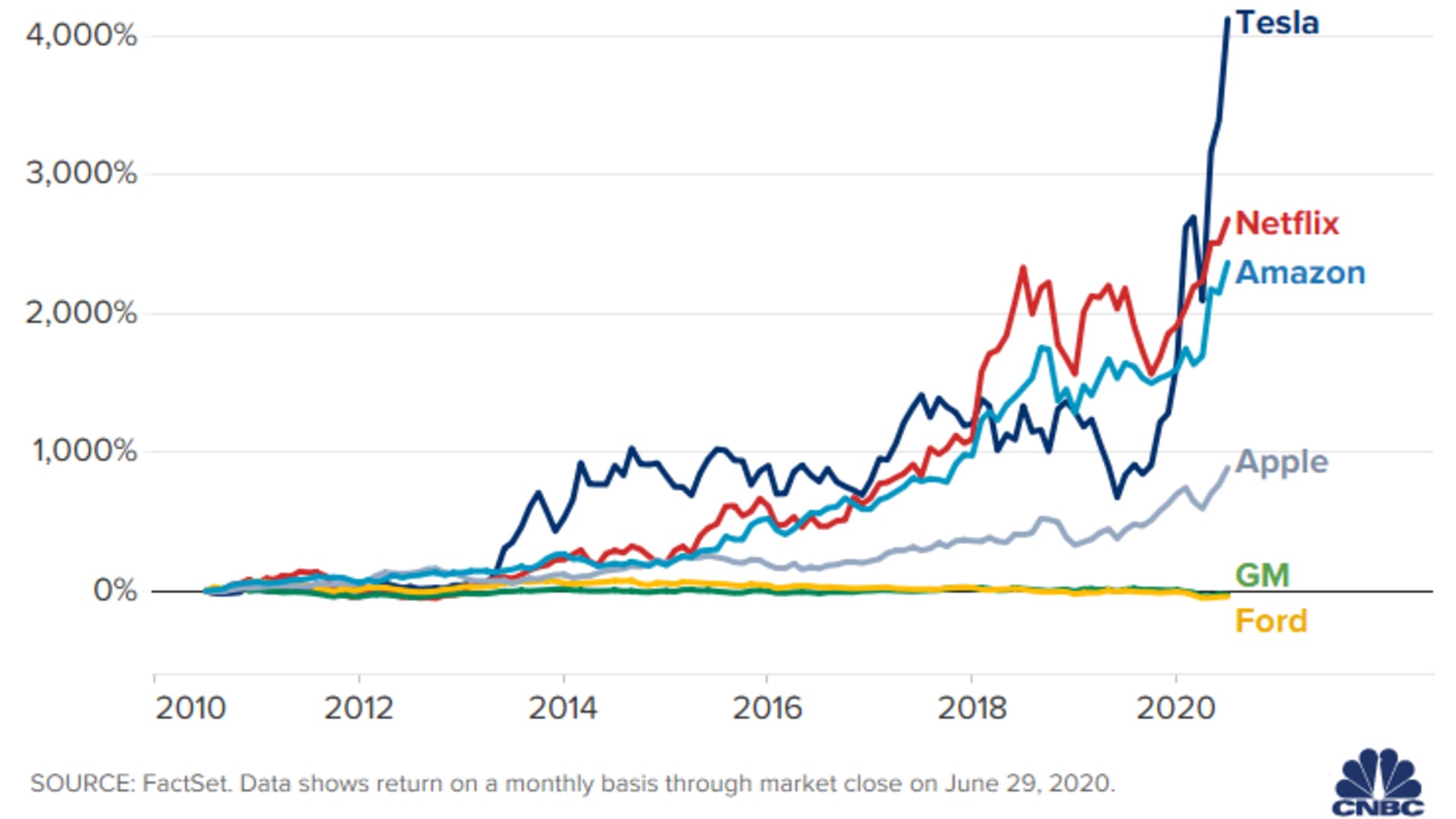

Tesla's stock price has experienced significant fluctuations over the years, reflecting both the company's successes and challenges. Since its IPO in 2010, Tesla's stock has seen exponential growth, making it one of the most valuable companies in the world.

Tesla Stock Price Trends

Key trends in Tesla's stock performance include:

- Rapid growth during the early 2010s as Tesla launched new models.

- Increased volatility in 2018 due to production challenges and regulatory scrutiny.

- Unprecedented gains in 2020 and 2021, driven by strong financial results and market sentiment.

Data from sources like Bloomberg and Yahoo Finance indicate that Tesla's stock price has consistently outperformed the broader market, making it a favorite among growth investors.

Read also:Acdc Band Members The Rock Legends Behind The Music

Factors Affecting Tesla Stock Price

Several factors influence Tesla's stock price, including:

Economic Conditions

The overall health of the economy plays a critical role in Tesla's stock performance. During periods of economic growth, investors are more likely to invest in high-growth stocks like Tesla.

Industry Trends

The EV industry's rapid expansion and increasing demand for renewable energy solutions have boosted Tesla's stock price. Government incentives and policies promoting clean energy further support Tesla's growth.

Company Performance

Tesla's financial results, production targets, and innovation in technology directly impact its stock price. Strong earnings reports and successful product launches often lead to stock price increases.

Investment Opportunities in Tesla

Tesla offers numerous investment opportunities for those interested in the EV and renewable energy sectors. Investors can purchase Tesla stock directly or through exchange-traded funds (ETFs) that include Tesla in their portfolios.

Long-term investors are attracted to Tesla's vision and potential for continued growth, while short-term traders capitalize on the stock's volatility.

Market Analysis of Tesla Stock

An in-depth analysis of Tesla's stock reveals a strong correlation between its performance and broader market trends. According to data from reputable financial institutions, Tesla's stock price has consistently outperformed the S&P 500, making it an attractive option for investors seeking high returns.

Comparison with Competitors

Compared to traditional automakers, Tesla's stock price reflects its leadership in innovation and technology. Competitors in the EV space, such as Rivian and Lucid Motors, have also seen their stock prices rise, but Tesla remains the dominant player.

Risks Associated with Tesla Stock

While Tesla's stock price has shown impressive growth, there are risks to consider:

Volatility

Tesla's stock is known for its high volatility, which can result in significant price swings. Investors must be prepared for potential losses in the short term.

Regulatory Challenges

As Tesla expands globally, it faces regulatory hurdles in various markets. Compliance with environmental and safety standards can impact production and profitability.

Competition

With more companies entering the EV market, Tesla faces increasing competition. This could affect its market share and stock price.

Future Outlook for Tesla Stock

The future of Tesla's stock price looks promising, driven by continued innovation and expansion into new markets. The company's focus on sustainability and cutting-edge technology positions it well for long-term success.

Analysts predict that Tesla's stock price will continue to grow as the demand for EVs increases globally. However, investors should remain cautious and monitor market conditions closely.

Expert Predictions and Forecasts

Financial experts and analysts have provided various forecasts for Tesla's stock price. Many predict that Tesla's stock will reach new highs in the coming years, fueled by strong demand for its products and expanding production capabilities.

According to a report by Bloomberg, Tesla's stock price could exceed $1,000 per share by the end of the decade, assuming favorable market conditions and continued innovation.

Tips for Investors Considering Tesla Stock

For those interested in investing in Tesla, here are some tips to consider:

- Conduct thorough research on Tesla's financial performance and industry trends.

- Diversify your portfolio to mitigate risks associated with Tesla's volatility.

- Stay informed about regulatory changes and market conditions that may impact Tesla's stock price.

Conclusion

Tesla's stock price has become a key indicator of the company's success and potential in the EV and renewable energy markets. By understanding the factors influencing Tesla's stock and staying informed about market trends, investors can make informed decisions about their investments.

We encourage readers to share their thoughts and experiences with Tesla stock in the comments section below. Additionally, feel free to explore other articles on our site for more insights into the world of investing and finance.