The recent announcement by the Commerce Secretary urging Americans to purchase Tesla stock has ignited a heated debate surrounding ethics, government influence, and financial transparency. This unexpected move has left many wondering about the implications of such a public endorsement and its potential impact on the stock market. As the controversy unfolds, it becomes crucial to understand the context, implications, and long-term effects of this decision.

Investors and analysts alike are now dissecting the reasoning behind the Commerce Secretary's recommendation and questioning whether it aligns with ethical standards. The intersection of government influence and corporate interests has always been a delicate balance, and this incident brings that tension into sharp focus. The public is now demanding answers about the motivations behind this unprecedented move.

In this article, we will delve deep into the nuances of this controversial decision, exploring its potential consequences, the ethical considerations involved, and how it may reshape the relationship between government officials and the private sector. By the end of this article, you will have a comprehensive understanding of the implications of the Commerce Secretary's actions and the broader context in which they occurred.

Read also:Aaron Pierre Wife Jessica Hardwick A Comprehensive Guide

Table of Contents

- Background: The Commerce Secretary's Announcement

- Ethics Debate: Conflict of Interest or Strategic Move?

- Market Impact: How Tesla Stock Reacted

- The Role of Government in Stock Recommendations

- Historical Context: Similar Incidents in the Past

- Tesla Overview: A Company on the Rise

- Public Opinion: What People Are Saying

- Legal Considerations: The Fine Line Between Advice and Influence

- Future Implications: What Lies Ahead?

- Conclusion: Reflecting on the Ethics Debate

Background: The Commerce Secretary's Announcement

The Commerce Secretary's decision to publicly advocate for Tesla stock purchases came as a surprise to many. In a press conference, the Secretary emphasized the importance of supporting innovative companies that drive economic growth. Tesla, being a pioneer in the electric vehicle (EV) industry, was highlighted as a prime example of such innovation.

This announcement was not just a casual suggestion but rather a formal recommendation aimed at encouraging Americans to invest in Tesla. The rationale provided was that Tesla's growth aligns with the nation's goals for sustainable energy and technological advancement. However, the timing and manner of the announcement raised eyebrows, leading to an immediate backlash from critics who questioned the Secretary's intentions.

Key Points in the Announcement

- Public endorsement of Tesla as a leading innovator in the EV sector.

- Call to action for Americans to consider Tesla as a sound investment opportunity.

- Emphasis on Tesla's alignment with national sustainability objectives.

Ethics Debate: Conflict of Interest or Strategic Move?

One of the primary concerns surrounding the Commerce Secretary's recommendation is the potential conflict of interest. Critics argue that government officials should maintain a neutral stance when it comes to endorsing specific companies or stocks. This neutrality ensures that the public's trust in governmental institutions remains intact.

Proponents of the Secretary's decision, however, view it as a strategic move to boost the economy by supporting a company that contributes significantly to technological innovation and job creation. They argue that the endorsement aligns with broader economic goals and should not be seen as a personal or political agenda.

Evaluating Ethical Standards

- Assessing whether the endorsement violates existing ethical guidelines for government officials.

- Exploring the potential benefits of supporting innovative companies through public endorsements.

- Examining the risks associated with perceived bias or favoritism in governmental recommendations.

Market Impact: How Tesla Stock Reacted

The immediate reaction of the stock market to the Commerce Secretary's announcement was significant. Tesla's stock price experienced a noticeable uptick following the press conference, with investors rushing to capitalize on the perceived endorsement. Analysts noted that the surge in interest was partly driven by the credibility associated with a government official's recommendation.

However, the long-term impact remains uncertain. While the initial boost in stock prices is promising, skeptics warn that such endorsements could lead to market volatility if investors begin to rely heavily on governmental advice rather than conducting their own due diligence.

Read also:Sam Rockwells Triumph Oscar Glory Unveiled

Factors Influencing Market Response

- Investor sentiment and trust in government recommendations.

- Potential risks of over-reliance on official endorsements for investment decisions.

- Historical precedents of stock market reactions to similar announcements.

The Role of Government in Stock Recommendations

The role of government in stock recommendations is a topic of ongoing debate. Traditionally, government officials are expected to provide guidance on broader economic policies rather than endorsing specific companies or stocks. However, in an era where economic growth is increasingly tied to technological innovation, the lines between public and private sector interests can become blurred.

This incident highlights the need for clearer guidelines on how government officials should engage with the financial markets. Establishing these guidelines can help prevent future conflicts of interest and ensure that public trust in governmental institutions remains strong.

Historical Context: Similar Incidents in the Past

To better understand the current situation, it is essential to examine historical incidents where government officials have made similar recommendations. One notable example is the endorsement of certain industries during economic downturns, aimed at stimulating recovery. While these endorsements were often well-intentioned, they sometimes led to unintended consequences, such as market distortions or accusations of favoritism.

By analyzing these past incidents, we can gain valuable insights into the potential outcomes of the Commerce Secretary's recent announcement and the steps that can be taken to mitigate any negative effects.

Lessons from History

- Examples of government endorsements in previous economic climates.

- Outcomes and consequences of such endorsements on the stock market.

- Recommendations for improving future governmental engagement with financial markets.

Tesla Overview: A Company on the Rise

Tesla, Inc. is a global leader in the electric vehicle and clean energy industry. Founded in 2003, the company has revolutionized the automotive sector with its cutting-edge technology and commitment to sustainability. Tesla's mission to accelerate the world's transition to sustainable energy resonates with a growing number of environmentally conscious consumers.

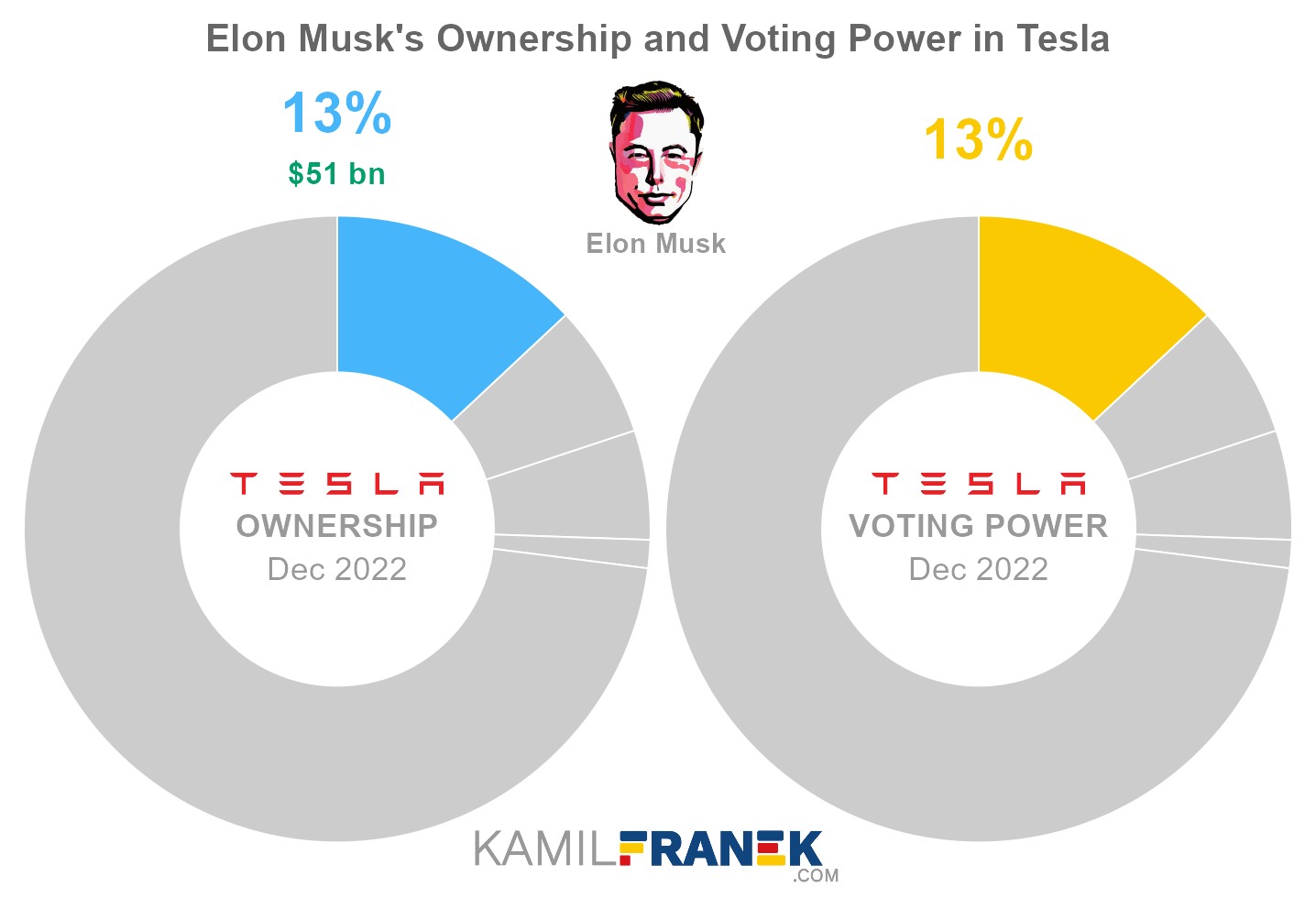

Under the leadership of CEO Elon Musk, Tesla has achieved remarkable milestones, including the development of the Model S, Model 3, Model X, and Model Y vehicles. The company's innovations extend beyond automobiles, with Tesla Energy offering solar panels and energy storage solutions that further contribute to a greener future.

Tesla's Key Achievements

- Global leader in electric vehicle production and sales.

- Pioneering advancements in autonomous driving technology.

- Expanding presence in the renewable energy sector through Tesla Energy.

Public Opinion: What People Are Saying

Public reaction to the Commerce Secretary's announcement has been mixed. While some view it as a positive step towards supporting innovation and economic growth, others express concerns about the potential for abuse of power. Social media platforms have been abuzz with discussions, with users sharing their thoughts on the ethical implications of the endorsement.

Surveys conducted by financial news outlets indicate that a significant portion of the public is skeptical about the motivations behind the announcement. Many are calling for greater transparency and accountability from government officials to ensure that such endorsements are made in the best interest of the public.

Public Sentiment Analysis

- Positive reactions from those who support government involvement in promoting innovation.

- Concerns raised by critics regarding potential conflicts of interest.

- Call for increased transparency and accountability in future governmental recommendations.

Legal Considerations: The Fine Line Between Advice and Influence

From a legal perspective, the Commerce Secretary's recommendation raises several important considerations. While there is no explicit law prohibiting government officials from endorsing specific stocks, ethical guidelines and conflict of interest regulations may still apply. Ensuring compliance with these regulations is crucial to maintaining public trust.

Legal experts are closely monitoring the situation to determine whether any boundaries have been crossed. The outcome of this analysis could have far-reaching implications for how government officials engage with the financial markets in the future.

Future Implications: What Lies Ahead?

The long-term implications of the Commerce Secretary's announcement are yet to be fully realized. As the debate continues, it is clear that this incident will shape the future relationship between government officials and the private sector. Establishing clear guidelines and regulations will be essential to preventing similar controversies in the future.

Investors, policymakers, and the general public must remain vigilant in holding government officials accountable for their actions. By fostering a culture of transparency and accountability, we can ensure that such endorsements are made with the best intentions and in the public's best interest.

Conclusion: Reflecting on the Ethics Debate

The Commerce Secretary's recommendation to purchase Tesla stock has sparked a significant ethics debate, highlighting the delicate balance between government influence and corporate interests. While the intention behind the announcement may have been to support innovation and economic growth, the potential for conflicts of interest cannot be ignored.

As we move forward, it is crucial to establish clear guidelines and regulations to govern how government officials engage with the financial markets. By doing so, we can ensure that such endorsements are made transparently and with the public's best interests in mind. We invite you to share your thoughts and opinions in the comments section below and encourage you to explore other articles on our site for further insights into this and related topics.