IRS errors can cause significant financial stress, especially when they block substantial refunds like $11,000. This issue affects thousands of taxpayers annually, and understanding the root cause is crucial to resolving it effectively.

Many taxpayers encounter IRS errors that delay or block their refunds. These errors can range from simple data entry mistakes to more complex issues like identity theft or processing errors. The impact of these mistakes can be financially devastating, particularly for individuals relying on their tax refunds.

In this article, we will explore the reasons behind the IRS error blocking $11k tax refunds, how to identify the problem, and the steps taxpayers can take to resolve it. By understanding the process and available resources, taxpayers can protect their finances and ensure they receive their rightful refunds.

Read also:The Ultimate Guide To Tv Shows Starring Cha Eun Woo A Cinematic Journey

Table of Contents

- Introduction to IRS Errors

- Common IRS Errors That Block Refunds

- The Impact of IRS Errors on Taxpayers

- How to Identify IRS Errors in Your Refund

- Steps to Resolve IRS Errors

- Preventing IRS Errors

- IRS Error Statistics

- Available Resources for Taxpayers

- Expert Advice on Dealing with IRS Errors

- Conclusion and Next Steps

Introduction to IRS Errors

The Internal Revenue Service (IRS) processes millions of tax returns each year, and while the system is designed to be efficient, errors can still occur. One of the most frustrating issues taxpayers face is when an IRS error blocks their refund, especially if it's a significant amount like $11,000. These errors can stem from various sources, including incorrect information provided by the taxpayer, processing mistakes, or even fraud.

Types of IRS Errors

IRS errors can be categorized into several types:

- Data Entry Errors

- Processing Delays

- Identity Theft

- Underreported Income

Each type requires a different approach to resolution, making it essential for taxpayers to understand the specific issue affecting their refund.

Common IRS Errors That Block Refunds

One of the most common IRS errors is incorrect Social Security numbers (SSNs) or names on tax returns. Even a small typo can lead to a refund being blocked. Another frequent issue is underreported income, where the IRS believes the taxpayer has not reported all their earnings, leading to a hold on the refund.

Examples of Common Errors

Here are some examples of common IRS errors:

- Incorrect SSN or Name

- Underreported Income

- Identity Theft

- Missing Documentation

These errors can delay refunds for weeks or even months, causing financial strain for many taxpayers.

Read also:Ultimate Guide To Golden Retriever Puppies Adoption What You Need To Know

The Impact of IRS Errors on Taxpayers

IRS errors that block refunds, such as the $11k refund issue, can have a profound impact on taxpayers. Many individuals rely on their tax refunds to cover essential expenses like rent, utilities, or medical bills. When these refunds are delayed or blocked, it can lead to significant financial hardship.

According to a report by the IRS Taxpayer Advocate Service, approximately 1 million taxpayers experienced refund delays in 2022 due to IRS errors. This highlights the widespread nature of the problem and the importance of addressing it promptly.

How to Identify IRS Errors in Your Refund

Identifying IRS errors in your refund requires vigilance and attention to detail. Taxpayers should regularly check the IRS "Where's My Refund?" tool to track the status of their refund. If the status shows "delayed" or "under review," it may indicate an error that needs addressing.

Steps to Identify IRS Errors

Here are some steps to help identify IRS errors:

- Check the IRS "Where's My Refund?" Tool

- Review Your Tax Return for Errors

- Contact the IRS for More Information

By following these steps, taxpayers can quickly identify and address potential issues with their refunds.

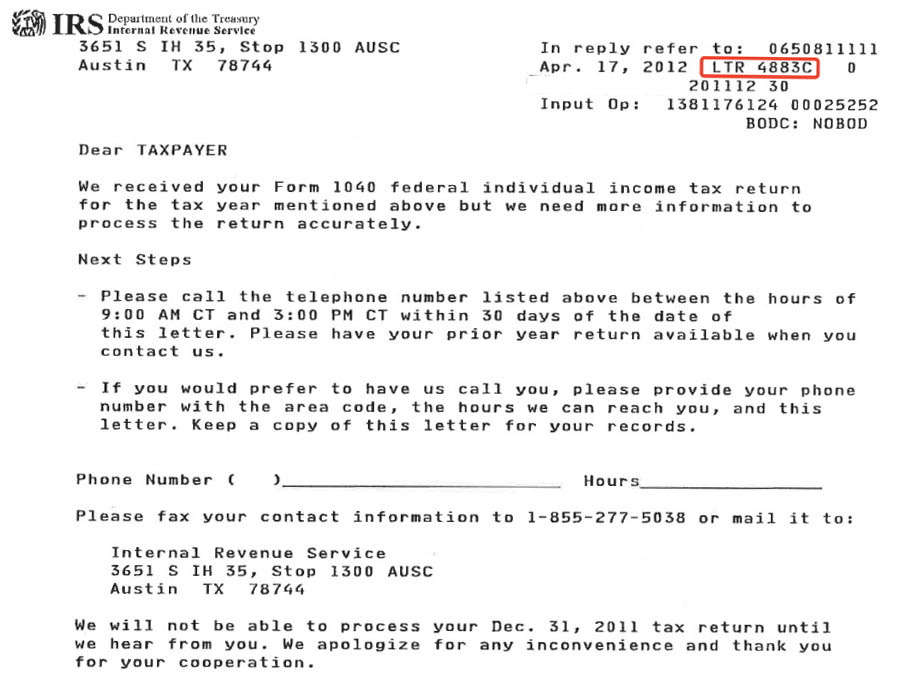

Steps to Resolve IRS Errors

Once an IRS error has been identified, taxpayers must take immediate action to resolve the issue. The first step is to gather all necessary documentation, including tax returns, W-2s, and any correspondence from the IRS. This documentation will be crucial in proving the accuracy of the information provided.

Steps to Resolve IRS Errors

Here are some steps to resolve IRS errors:

- Gather All Necessary Documentation

- Contact the IRS to Report the Error

- Submit Any Missing Information

It's important to remain patient and persistent when dealing with the IRS, as resolving errors can take time.

Preventing IRS Errors

Preventing IRS errors starts with careful preparation and attention to detail when filing tax returns. Taxpayers should double-check all information for accuracy, including SSNs, names, and income figures. Additionally, using tax software or consulting a tax professional can help reduce the likelihood of errors.

Tips for Preventing IRS Errors

Here are some tips for preventing IRS errors:

- Double-Check All Information Before Filing

- Use Tax Software or Consult a Tax Professional

- Respond Promptly to IRS Requests

By following these tips, taxpayers can minimize the risk of encountering IRS errors that block their refunds.

IRS Error Statistics

Data from the IRS and independent studies reveal alarming statistics about IRS errors. In 2022, the IRS processed over 240 million tax returns, with an estimated error rate of 2%. This equates to approximately 4.8 million returns affected by errors, many of which resulted in delayed or blocked refunds.

According to a report by the National Taxpayer Advocate, the IRS received over 10 million calls related to refund issues in 2022, with a significant portion attributed to errors. These statistics underscore the need for improved processes and better communication between the IRS and taxpayers.

Available Resources for Taxpayers

Taxpayers facing IRS errors have access to several resources to help resolve their issues. The IRS provides a helpline and online tools, such as the "Where's My Refund?" tracker, to assist taxpayers in tracking their refunds and addressing errors. Additionally, organizations like the Taxpayer Advocate Service offer support and advocacy for taxpayers dealing with complex issues.

Key Resources for Taxpayers

Here are some key resources for taxpayers:

- IRS Helpline

- Where's My Refund? Tool

- Taxpayer Advocate Service

Utilizing these resources can help taxpayers navigate the often complex process of resolving IRS errors.

Expert Advice on Dealing with IRS Errors

Financial experts and tax professionals recommend several strategies for dealing with IRS errors. One key piece of advice is to maintain detailed records of all correspondence with the IRS, including dates, times, and the names of representatives spoken to. This documentation can be invaluable in resolving disputes.

Another recommendation is to seek professional assistance if the issue becomes too complex. Tax professionals have the expertise and experience to navigate IRS processes and advocate on behalf of their clients.

Conclusion and Next Steps

IRS errors that block refunds, such as the $11k refund issue, can be frustrating and financially damaging for taxpayers. However, by understanding the causes of these errors and taking proactive steps to resolve them, taxpayers can protect their finances and ensure they receive their rightful refunds.

We encourage readers to take action by checking their refund status regularly, gathering necessary documentation, and contacting the IRS if an error is identified. Additionally, we invite readers to share their experiences and tips in the comments section below, helping others navigate similar challenges.

For more information on tax-related topics, explore our other articles and resources. Together, we can empower taxpayers with the knowledge and tools they need to manage their finances effectively.