The 10-year treasury is one of the most important financial instruments in the global economy, serving as a benchmark for interest rates and economic health. Whether you're a seasoned investor or just starting your financial journey, understanding the 10-year treasury can provide valuable insights into market trends and economic stability. In this article, we'll delve into everything you need to know about the 10-year treasury, from its basics to its implications in the financial world.

For decades, the 10-year treasury has been a cornerstone of financial markets, offering a reliable gauge of economic sentiment. Governments, corporations, and individual investors all rely on this instrument to make informed decisions. This article aims to break down complex financial concepts into digestible information, ensuring that readers, regardless of their financial expertise, can grasp its significance.

As we navigate through the complexities of modern finance, the 10-year treasury remains a critical indicator of market sentiment and economic health. By the end of this article, you'll have a comprehensive understanding of its role in shaping financial strategies and influencing global markets.

Read also:1964 Nickel Value A Comprehensive Guide To Insights And Considerations

What is the 10-Year Treasury?

The 10-year treasury refers to a government bond issued by the U.S. Department of the Treasury with a maturity period of 10 years. These bonds are considered one of the safest investments due to the backing of the U.S. government, making them a benchmark for other fixed-income securities. Investors purchase these bonds to earn interest over the 10-year period, receiving regular interest payments until the bond matures.

Key Features of the 10-Year Treasury

The 10-year treasury offers several distinct features that make it a popular choice among investors:

- Fixed Interest Rate: The bond pays a fixed interest rate, providing predictable income.

- Government Backing: Backed by the full faith and credit of the U.S. government, ensuring high creditworthiness.

- Market Benchmark: Serves as a benchmark for other bonds and financial instruments, influencing interest rates across the board.

Why is the 10-Year Treasury Important?

The importance of the 10-year treasury extends beyond its role as a safe investment. It acts as a barometer for economic health and investor sentiment. Changes in the yield of the 10-year treasury can signal shifts in the broader economy, influencing decisions made by central banks, corporations, and individual investors.

Impact on Mortgage Rates

One of the most significant impacts of the 10-year treasury is its influence on mortgage rates. Since many mortgage rates are tied to the yield of the 10-year treasury, fluctuations in its yield can directly affect the cost of home loans. For instance, a rise in the yield often leads to higher mortgage rates, impacting the housing market.

How Does the 10-Year Treasury Work?

The mechanics of the 10-year treasury are relatively straightforward. When the U.S. government issues these bonds, investors purchase them at a set price and interest rate. Over the next decade, the bondholder receives periodic interest payments, typically every six months. At the end of the 10-year period, the investor receives the face value of the bond.

Yield and Pricing

The yield of the 10-year treasury is inversely related to its price. When demand for the bond increases, its price rises, causing the yield to fall. Conversely, if demand decreases, the price drops, leading to a higher yield. This dynamic relationship plays a crucial role in determining the attractiveness of the bond to investors.

Read also:Joss Whedon The Visionary Creator Behind Iconic Tv Shows And Films

Who Invests in the 10-Year Treasury?

A wide range of investors, both domestic and international, participate in the 10-year treasury market. These include:

- Individual Investors: Seeking safe, long-term investments with predictable returns.

- Institutional Investors: Such as pension funds and insurance companies, which require stable investments to meet future obligations.

- Foreign Governments: Often purchase U.S. treasuries as part of their foreign exchange reserves.

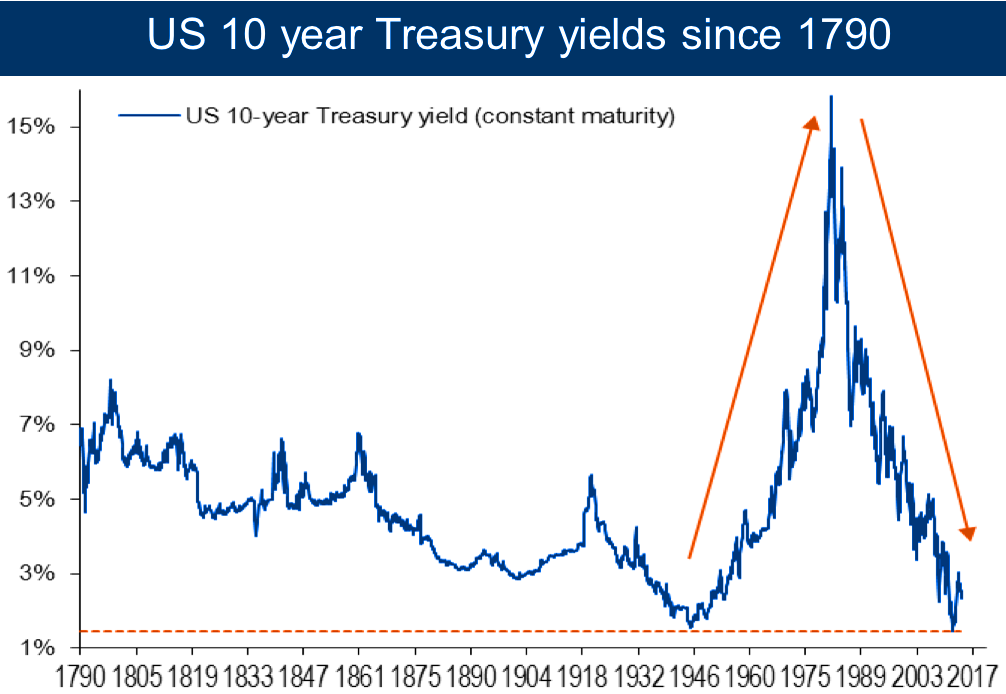

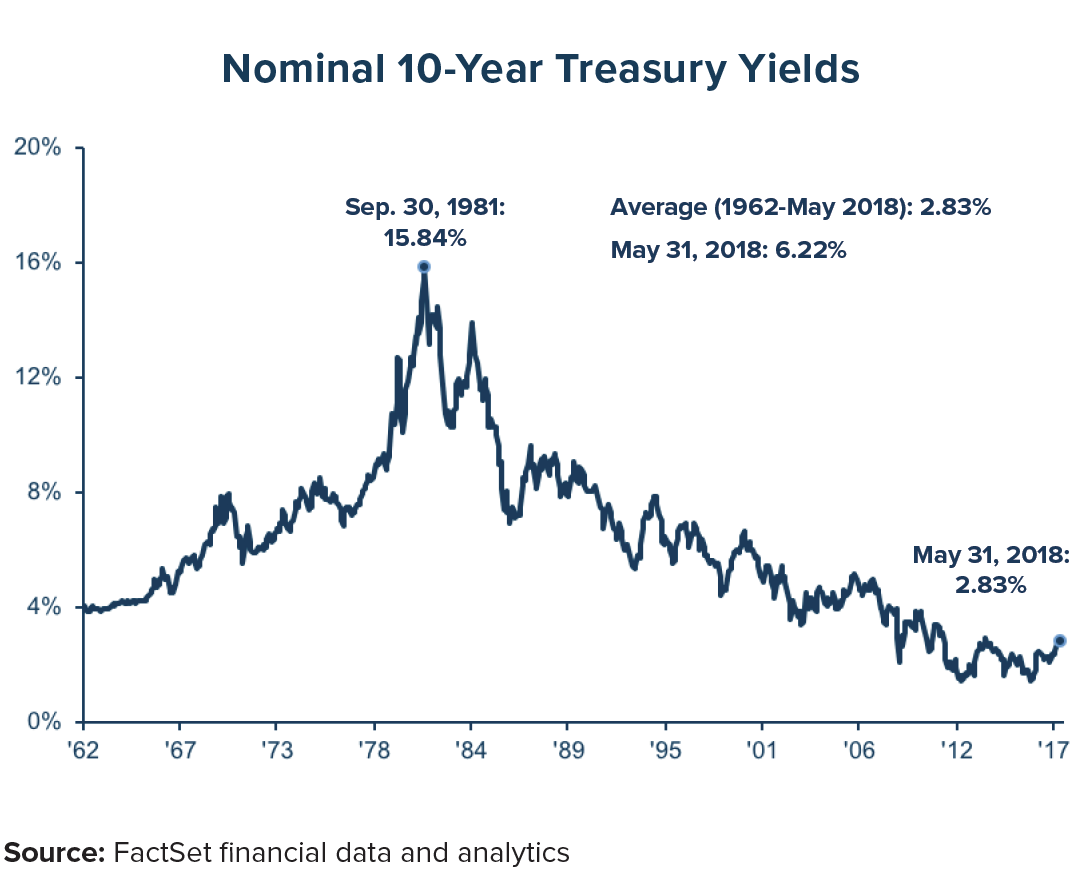

Historical Performance of the 10-Year Treasury

Examining the historical performance of the 10-year treasury provides valuable insights into its role in the economy. Over the past few decades, the yield on the 10-year treasury has experienced significant fluctuations, reflecting changes in economic conditions and monetary policy.

Key Historical Events

Several key events have influenced the 10-year treasury's performance:

- 1980s: High inflation led to elevated interest rates, resulting in higher yields.

- 2008 Financial Crisis: The yield dropped significantly as investors sought safe-haven assets.

- Post-2020 Pandemic: Yields initially plummeted but later rebounded as economic recovery gained traction.

Factors Influencing the 10-Year Treasury

Several factors can impact the yield and demand for the 10-year treasury:

- Economic Growth: Strong economic growth often leads to higher yields as investors anticipate inflation and rate hikes.

- Federal Reserve Policy: Actions by the Federal Reserve, such as changes in interest rates or quantitative easing, can significantly affect the treasury market.

- Global Events: Political instability or geopolitical tensions can drive investors toward the safety of U.S. treasuries.

10-Year Treasury vs. Other Bonds

While the 10-year treasury is a popular choice, it competes with other types of bonds in the market. Understanding the differences can help investors make informed decisions:

- Corporate Bonds: Offer higher yields but come with greater risk.

- Municipal Bonds: Provide tax advantages but may have lower yields.

- Short-Term Treasuries: Offer less risk but also lower returns compared to the 10-year treasury.

Risks Associated with the 10-Year Treasury

Despite its reputation as a safe investment, the 10-year treasury is not without risks:

- Interest Rate Risk: Rising interest rates can decrease the value of existing bonds.

- Inflation Risk: Inflation can erode the purchasing power of fixed interest payments.

- Liquidity Risk: Although generally liquid, market disruptions can temporarily affect trading.

Future Outlook for the 10-Year Treasury

Looking ahead, the 10-year treasury will continue to play a pivotal role in global finance. With ongoing economic challenges and evolving monetary policies, its yield and performance will remain closely watched indicators of economic health.

Key Trends to Watch

Some key trends to monitor include:

- Central Bank Policies: How major central banks respond to inflation and economic growth.

- Global Trade Dynamics: The impact of trade relations on treasury demand.

- Technological Advancements: How technology might influence financial markets and treasury yields.

Conclusion

In summary, the 10-year treasury is a critical component of the global financial system, offering stability and insight into economic conditions. By understanding its mechanics, historical performance, and influencing factors, investors can better navigate the complexities of modern finance. We encourage you to share your thoughts or questions in the comments below and explore other articles on our site for further insights into the world of finance.

Table of Contents

- What is the 10-Year Treasury?

- Why is the 10-Year Treasury Important?

- How Does the 10-Year Treasury Work?

- Who Invests in the 10-Year Treasury?

- Historical Performance of the 10-Year Treasury

- Factors Influencing the 10-Year Treasury

- 10-Year Treasury vs. Other Bonds

- Risks Associated with the 10-Year Treasury

- Future Outlook for the 10-Year Treasury

- Conclusion

References:

- U.S. Department of the Treasury

- Federal Reserve Economic Data (FRED)

- Investopedia